tax lien nj sales

Tax sales are conducted by the tax collector. If at the sale a person shall offer to purchase subject to redemption at a rate of interest less than 1 he may in lieu of any rate of interest to redeem offer a premium over and above the amount of taxes assessments or other charges as in this chapter specified due the municipality and the property shall be struck off and sold to the.

A tax lien is filed against you with the Clerk of the New Jersey Superior Court.

. Tax sales are scheduled each year by the Tax Collector and are advertised in the Bergen Record four weeks prior. In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale. Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30.

New Jersey Tax Deed Sales New Jersey does have tax deed sales. There are currently 142799 tax lien-related investment opportunities in New Jersey including tax lien foreclosure properties that are either available for sale or worth pursuing. Documents Tax Sale List PDF.

18 per annum and 4 6 penalty. Each municipality has a tax lien sale once a year. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien certificates greater than 10000 a 6 penalty is added.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. There are currently 343 tax lien-related investment opportunities in Elizabeth NJ including tax lien foreclosure properties that are either available for sale or worth pursuing. Ad Get Free Instant Access To The US Tax Lien Associations 4 Module Online Course.

All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. Three direct mailings required for which a fee not to exceed 25 each may be charged cost added to the cost of sale. Interest Rate andor Penalty Rate.

Some municipalities are on a fiscal year ending in June while some are on a calendar year ending in December. New Jersey is a good state for tax lien certificate sales. Tax LienWinning Premium Bid 28185514600 142242228110.

Leonia NJ Posted Mar 29 2012 1000 So I went to my first ever NJ Tax Lien Sale couple of weeks back. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. ALL of the properties sold at pretty insane premiums.

Tax Sale information and forms can be obtained from - The Official Website of The Township of West Caldwell NJ - Tax Collection Water Billing. Investing in tax liens in Elizabeth NJ is one of the least publicized but safest ways to make money in real estate. There are over 550 municipalities in New Jersey.

You do not have to wait until the due date to file. Its the end of the year and the holiday season and one of the busiest months for tax sales in New Jersey. Interest Rate 18 or more depending on penalties.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Middlesex County NJ at tax lien auctions or online distressed asset sales. Detailed listings of foreclosures short sales auction homes land bank properties. Third parties and the municipality bid on the tax sale certificates TSC.

Middlesex County NJ currently has 11858 tax liens available as of July 1. Tax sale liens are obtained through a bidding process. Of the 20th day of the month after the end of the filing period.

Office hours are Monday through Friday 830 am. Added omitted assessments Sewer charges Special assessment charges Taxes Water charges Tax Sale Process. Watch 4min Video That Explains All.

Big Secret Banks May Not Want Exposed. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. A judgment entered in court that is available for public view.

The City of Trenton announces the tax sale of 2019 2nd quarter and prior year delinquent taxes and other municipal charges through an online auction. In fact the rate of return on. Redemption Period 2 years New Jersey Tax Lien Auctions Dates of sales vary depending on the municipality.

In fact the rate of return on. Any municipal lien remaining unpaid on the eleventh day of the eleventh month of the current fiscal year is subject to Tax Sale at anytime thereafter. Here is a summary of information for tax sales in New Jersey.

Notice of Sale may be a display ad minimum size of 2 x 3with a bold black border for four weeks. The municipality will enforce the collection of those charges by offering same for sale which will cause a Tax Lien Certificate to be sold and filed against the property. NJ 07102 973 733-6400 973 928-1238.

For a listing of all parcels delinquencies and costs including registration and bidding instructions please visit the Tax Lien Auction site. By selling off these tax liens municipalities generate revenue. Investing in tax liens in New Jersey is one of the least publicized but safest ways to make money in real estate.

CODs are filed to secure tax debt and to protect the interests of all taxpayers. Third parties and the municipality bid on the tax sale certificates TSC. When prior years.

Sales and Use Tax Online Filing and Payments Quarterly Sales and Use Tax Returns are due before 1159 pm. The Tax Collector shall continue to prepare the tax lien sale notice required pursuant to NJSA545-25 No fee allowed. Tax sales are conducted by the tax collector.

Tax Lien Certificates Sec. Please see below - tax lien amount on left premium bid on right. If the due date falls on a weekend or legal holiday the return and payment are due on the following business day.

By selling off these tax liens municipalities generate revenue. Its purpose is to give official notice that liens or judgments exist. Municipal charges include but are not limited to.

Nj Car Sales Tax Everything You Need To Know

Cheapest Ways To Sell A House Hauseit Things To Sell Selling Strategies Selling House

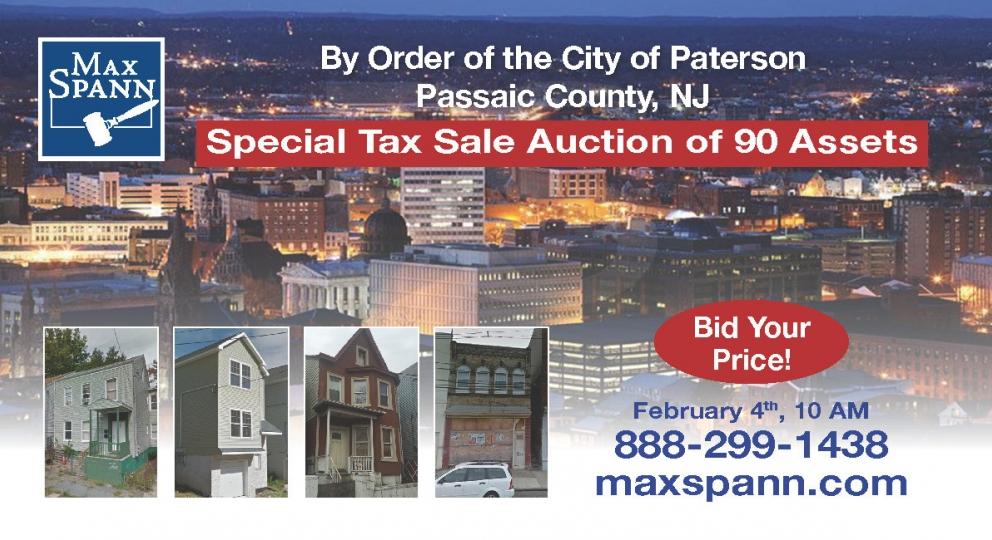

Special Tax Sale Auction Of 90 Assets By Order Of The City Of Paterson Nj Sold

1965 Ac Cobra 289 Very Original Dobson Motorsport Ac Cobra Lovely Car Power To Weight Ratio

Red Light Effect Party Invitation Flyer Party Invite Template Neon Party Invitations Free Printable Party Invitations

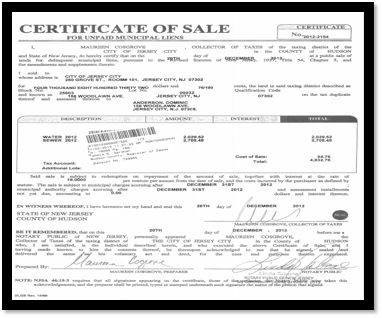

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Online Taxes Bid Tax

Special Tax Sale Auction Of 90 Assets By Order Of The City Of Paterson Nj Sold

2bhk Apartments For Sale In Sector 86 Faridabad Apartments For Sale Real Estate Property For Sale

97 Homes With Major Curb Appeal House Exterior Mediterranean Homes Spanish Style Homes

Leopaul S Blog Tagbond Mixer Invitation Mixer Invitations Makati City

Beware Of The Accelerated Tax Sales In New Jersey Tax Lien Investing Tips

Otc Tax Liens How We Made 6 In Less Than 120 Days With Tax Liens

Renewable Energy Real Estate Real Estate Software Electricity Prices