social security tax limit

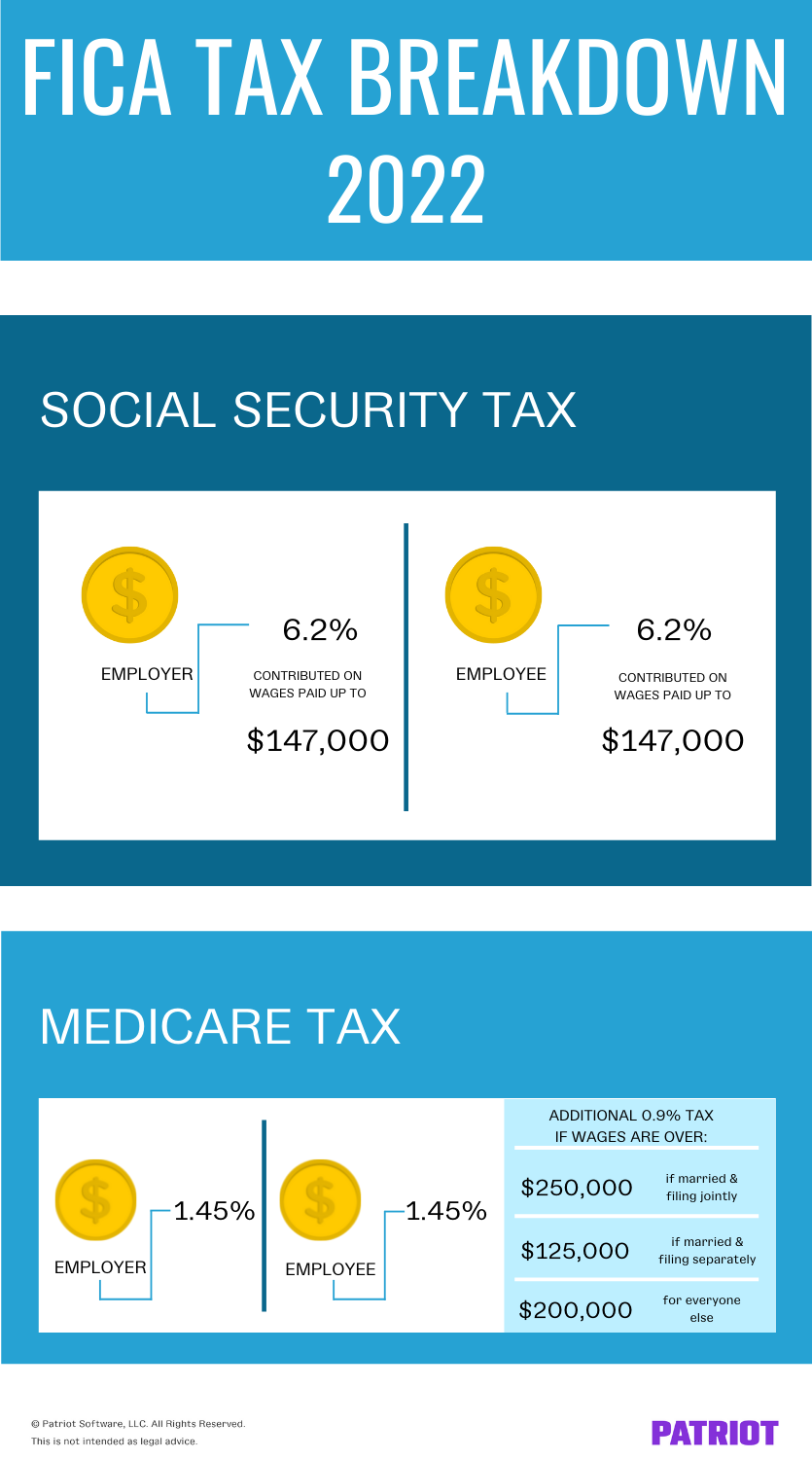

For earnings in 2022 this base is 147000. For self-employed workers the rate is 124.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Filing single single head of.

. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. According to the SSA a. The OASDI tax rate for wages paid in 2022 is currently set at 62 for employees and employers each.

Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is. More than 44000 up to 85 percent of your benefits may be taxable. As of 2021 the maximum earnings subject to social security taxes was 142800.

If a couple is married each person would. Refer to Whats New in Publication 15 for the. West Virginia has been gradually phasing out its tax on Social Security benefits and by 2022 those taxes will be history.

If you earn more than this amount you. But the amount has been increased to 147000 for 2022. The OASDI tax rate for wages paid in 2022 is set by statute at 62 for employees and employers so an individual with wages equal to or larger than 147000 would contribute.

For 2021 however taxpayers will still have to pay. 9 rows If you are working there is a limit on the amount of your earnings that is taxed by. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

This years limit is 137700 up. The 2022 limit for joint filers is 32000. Social Security Tax Limit Wage Base for 2020 - SmartAsset The wage base or earnings limit for the 62 Social Security tax rises every year.

For every 2 you exceed that limit 1 will be withheld in benefits. New Bill Could Give Seniors an Extra 2400 a Year Unlike many other tax cap limits this stands as an individual limit. The federal government changes this limit aka.

If that total is more than 32000 then part of their Social Security may be taxable. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021. Fifty percent of a taxpayers benefits may be taxable if they are.

The Social Security earnings limit is 1630 per month or 19560 per year in 2022 for someone who has not reached full retirement age. The maximum Social Security benefit is 4194 per month but there are a lot of requirements to meet. The exception to this dollar limit is in the calendar year that you will.

For 2022 the Social Security earnings limit is 19560. However if youre married and file separately youll likely have to pay taxes on your Social Security income. The 2021 tax limit is 5100 more than the 2020 taxable maximum.

The wage base limit is the maximum wage thats subject to the tax for that year.

Social Security What Is The Wage Base For 2023 Gobankingrates

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

What Is The Social Security Tax Limit

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Wage Base Increases To 142 800 For 2021

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

What Is Social Security Tax Calculations Reporting More

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Is The Social Security Tax Limit For 2022 Gobankingrates

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons