haven't filed taxes in years where do i start

I havent filed taxes in a few years. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Haven T Filed A Tax Return For A Few Years Here S What To Do Tax Relief Blog March 11 2013

What happens if you havent filed taxes for several years.

/GettyImages-1367788813-3e9f601f07874706bca823305a2b4015.jpg)

. If youve been making about that much per year for the past 10 years and always as an independent contractor no taxes withheld you could owe nearly 200000 in federal and state. Ad Get Reliable Answers to Tax Questions Online. Im 27 years old.

Penalties include up to one year in prison for each. Prepare to pay extra if. The government can hit you with civil and even criminal penalties for failing to file your return.

So last year I never filed I havent filed yet this year. Keep in mind federal. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the required return.

The state can also require you to pay your back taxes. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late filing penalty of 5 percent of the tax owing. To request past due return incomeinformation call the IRS at 866 681-4271.

IRS can provide Form W-2 transcripts for 2014 and 2015 free of charge. If you dont file a tax return you will be in violation of the law. I havent filed my.

If your return wasnt filed by the due date including extensions of time to file. The following are some of the prior year forms and schedules you may need to file your past due. The law requires you to file every year that you have a filing requirement.

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. First gather your documents. The deadline for claiming refunds on 2016 tax returns is April 15 2020.

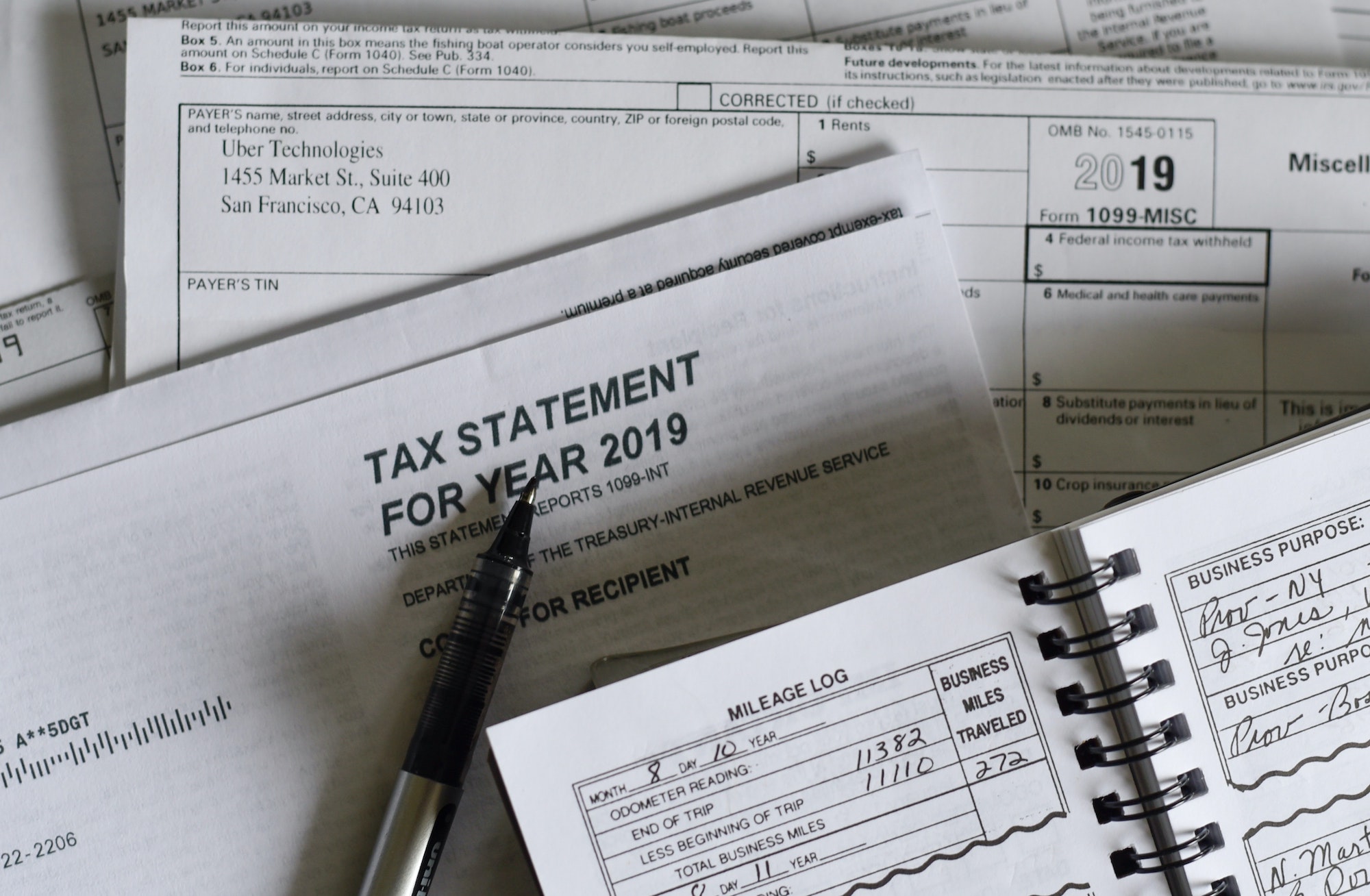

Havent filed my taxes in 3. Over the past two years my only source of income has been Uber Lyft. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available.

File Form 4506-T by mail or fax or access Get Transcript Online. I fell behind on everything in life for a while. Trying to get back on track hoping to submit everything.

When Are Taxes Due Tax Day Is Not April 15 In 2020 Money

How To File Taxes If You Haven T Filed In Years Youtube

Why Did The Irs File My Taxes For Me

What To Do If You Haven T Filed Your Taxes Yet Finance Wqow Com

:max_bytes(150000):strip_icc()/GettyImages-1327943657-4329f0ad754a437bb38eff0ee4df8609.jpg)

Taxes What To Do If You Haven T Filed

Haven T Filed Taxes In Years What You Should Do Youtube

How To Find Out Which Years Taxes Were Not Filed Sapling

I Haven T Filed Taxes In 5 Years How Do I Start

14 Tips If You Haven T Filed Taxes In Years Upsolve

I Haven T Filed Taxes Yet How Do I Submit The Fafsa Jlv College Counseling

What To Do If You Haven T Filed Your Taxes In Years Tax Resolution Attorney Blog August 21 2020

I Haven T Filed Taxes In 5 Years How Do I Start

Taxes 2022 What To Do If You Haven T Filed Your Return Yet

:max_bytes(150000):strip_icc()/GettyImages-1194849922-568c9eb7acce4a378f9062cae95340e4.jpg)

Taxes What To Do If You Haven T Filed

Several Years Of Late Form 1040 S What Are Your Options

Here S What To Know On Tax Day If You Still Haven T Filed Your Return

Can I Get A Stimulus Check Without Filing Taxes Saverlife

:max_bytes(150000):strip_icc()/hurricane-ian-update-092722-2-694a964d68064c1ea2da46cbd172bf54.jpg)